Travelling and money go hand in hand – if you want to see the world, it’s gonna cost you (although I have some tricks to cut costs HERE). Preparing for my own backpacking trip forced me to check my own bad spending habits and, frankly nonexistent, budgeting skills – so in the spirit of friendship I extend these tips to you.

1. Set a Budget

No matter how much money you have saved, or how little you need to know exactly how much money you have to spend each day. Have this amount seared into your mind. If you go over one day, then pull it back the next and if you are underspending either save that cash for a treat or to extend your trip.

2. Open a New Account

A savings account that you don’t have easy access to is a great thing. I used to have a savings account but as soon as I logged into my internet banking I was able to quickly siphon any funds into my current account. So to save I opened an account with a different bank and didn’t set up online banking for it. I just made sure I paid money INTO it and that’s it. The temptation to cheat was taken away.

3. Pay Yourself a ‘Wage’

From your new account set up a standing order to your current account each week, this will ensure you can’t overspend. If you get your card stolen you won’t get cleared out either. If you don’t have a separate account, give your money to a trusted family member and ask them to send you your ‘wage’ each week.

4. Use a Budgeting App

It’s so easy to blow your budget – a beer here, a tattoo there, several hundred ice creams – so get into the habit of logging your spending. It’s quite addictive and will ensure you stay on track.

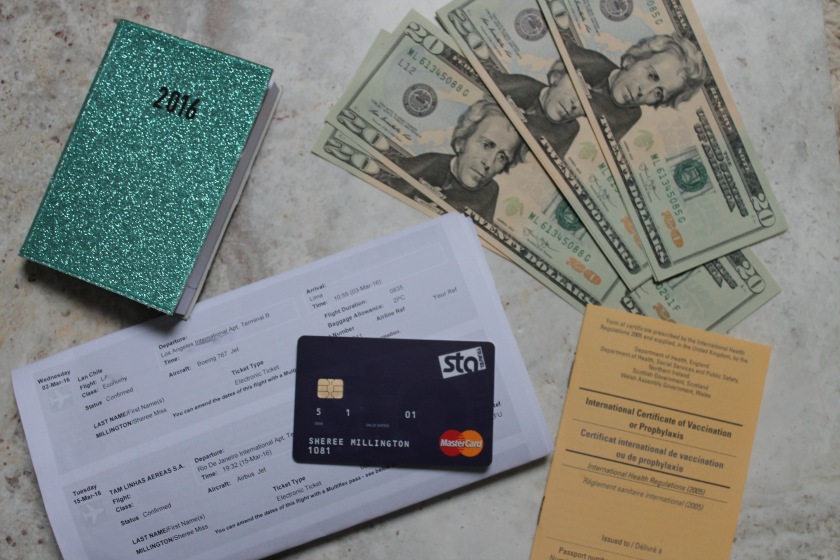

5. Take US Dollars

While I don’t recommend getting currency before you leave (use your debit card for good exchange rates, just watch withdrawal fees), it is useful in most countries to have some US dollars with you. It’s the universal money and could get you across borders or out of a pickle. I took about $200 in cash.

6. Get an Extra Card

The last thing you want is to lose a card and be stuck for cash. Take two separate cards and keep them apart so you always have the means to get money out. I have a STA money card too which is prepaid and can be used around the world. I’d recommend getting a credit card if you don’t have one too – only for absolute emergencies, but it’s peace of mind if you have to book a last minute flight.

7. Watch Out For Bank Charges

While I think it’s fine to take cash out of ATMs some banks do charge fees per withdrawal so don’t take out £10 at a time. Try and take most of your cash out a once to save on fees.

If you’re with HSBC like me, here’s the details:

If you use your HSBC debit card to withdraw money at an ATM abroad, there is normally a Non Sterling Cash Fee of 2% (minimum £1.75, maximum £5) for all withdrawals.

*This post is not sponsored or affiliated with any brand or company.

Great tips. I’d just like to make the point that some bank accounts provide debit cards you can use for free international withdrawals. For example, Nationwide’s Flex Plus. It will cost you £10 per month but comes with a bunch of extras (the travel insurance might be helpful if you’ve only got a shorter trip but won’t cover long backpacking trips) and you might find that the £10 is offset by not having the fees and also the fact that the account has a higher credit interest rate. I haven’t investigated beyond Nationwide in detail but it’s something to look into before you travel.

LikeLike

Hey, thanks for that. Yeah, I know some banks have no withdrawal fees but I have 3 accounts with HSBC so I decided to stay with them as I like the service (also laziness). I will just limit my withdrawals, although their exchange rates are really good when taking out foreign currency so that can also balance out any fees. I’m also taking some GBP cash with me to exchange in India as apparently that’s the best way to buy your Rupees. Thanks so much for reading! 🙂

LikeLike

Thanks for the tips!

LikeLike

You’re welcome, I hope they’re helpful!

LikeLiked by 1 person

ah, i like this article very useful

LikeLike

Good. I aim to be useful 😊

LikeLike